London builds dreams for students, from one international learner to another.

Home to world-class universities and some of the UK’s top academic institutions, London consistently attracts brilliant minds to thrive in England’s most vibrant and stunning metropolitan city.

Yet, its reputation for having the highest cost of living among UK cities remains a significant consideration for students.

International students planning to study in the UK must pay close attention to the cost of living in London.

Currently, student living expenses in London typically range between £1,770 and £2,750 per month.

This budget covers essentials such as accommodation, food, transport, and daily necessities.

With inflation and living costs rising steadily-housing alone having increased by over 10% in recent years-understanding these financial demands is crucial to ensure a comfortable and successful stay in the city.

Breaking Down the Cost of Living in London for Students

Living in London brings incredible opportunities, but it comes with its own financial challenges. On average, students can expect to spend between £1,770 and £2,750 per month to cover their basic needs.

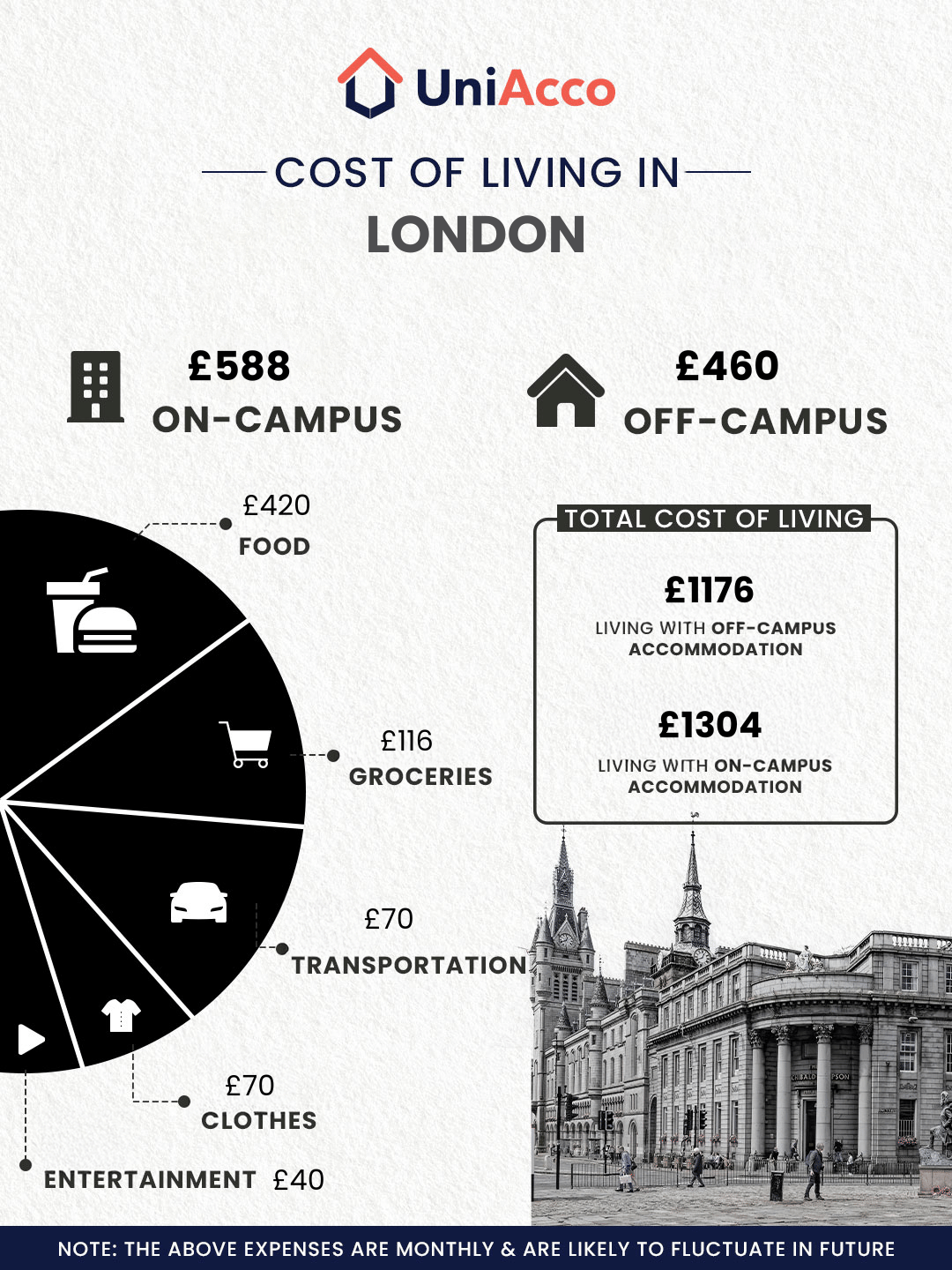

The cost of living in London comprises rent, food, transportation, utilities, and personal expenses.

| Expense Category | Approximate Monthly Cost (£) |

|---|---|

| On-Campus Accommodation | £450 – £800 |

| Off-Campus Accommodation | £300 – £600 |

| Groceries | £300 – £600 |

| Dining Out | £380 – £500 |

| Transportation | £70 – £150 |

| Utilities & Internet | £100 – £200 |

| Clothes | £100 – £300 |

| Total On-Campus Accommodation | £1100 – £1500 |

| Total Off-Campus Accommodation | £900 – £1200 |

| Annual Cost Of Living | £12,000 – £16,000 |

1. Cost Of Accommodation In London

London offers many accommodation options for students, from university residences to private apartments. Costs vary widely depending on the type of housing and its location in the city.

Understanding these options will help international students plan their budgets with confidence.

| Accommodation Type | Estimated Cost/month |

|---|---|

| University Residences | £500 – £1,000 |

| Private Student Accommodation (PBSA) | £700 – £1,600 |

| Shared Apartments | £400 – £900 |

| Private Apartments | £900 – £1,800 |

Understanding the range of accommodation costs is just the first step – next, let’s explore the different types of student accommodation in London and what makes each option unique for international students.

- University Residences

University residences are managed directly by the university and are often located within or very near to the campus. These accommodations usually provide furnished rooms with easy access to lecture theatres and campus facilities.

Rent typically covers utilities, internet, and access to amenities such as gyms, study lounges, and communal social spaces. Living on campus offers the convenience of a short commute and a supportive student community, making it ideal for first-year students seeking to immerse themselves in university life.

Average Cost: £500 – £1,000 per month (£120 – £230 per week)

- Private Student Accommodation (PBSA)

Privately Owned Student Accommodation (PBSA) comprises buildings specifically developed for students, but operated by private companies. These facilities offer a variety of room types, including en-suite rooms, studios, and shared flats, all of which are fully furnished with utilities and bills included in the rent.

PBSAs usually provide a higher standard of living with additional facilities like on-site gyms, communal lounges, laundry rooms, and security services. This option suits students who want modern amenities, more privacy, and often a more social community environment outside of university-managed housing.

Average Cost: £700 – £1,600 per month (£160 – £370 per week)

- Shared Apartments

Shared apartments give students a private bedroom while common spaces – like the kitchen, bathroom, and living room – are shared with flatmates. This arrangement offers more independence and a balanced social atmosphere.

It’s often the most cost-effective accommodation, especially for students comfortable managing shared living responsibilities like cleaning and utilities. Renting a room in a shared apartment can significantly reduce costs compared to studios or en-suite rooms, particularly in central London areas.

Average Cost: £400 – £900 per month (£90 – £210 per week)

- Private Apartments

Private apartments offer students complete control over their living space, with their own kitchen, bathroom, and living areas. Renting a private flat requires handling all utilities, internet, and furnishing unless it comes furnished.

This option provides maximum independence and privacy but tends to come at a higher cost and may require dealing with landlord contracts and bills. It’s best suited for students who prioritise independence or those with families.

Average Cost: £900 – £1,800 per month (£210 – £415 per week)

Finding the right private apartment can be overwhelming, especially with high rent and hidden costs. With UniAcco, you can compare verified private student flats in London, get all-inclusive options, and book at student-friendly rates.

Planning to move to London? Check out some of the best student accommodations in London!

Book through UniAcco today!

Cost Variations by Location

Although London is known for its high living costs, it offers a range of student-friendly areas that are more affordable. Popular zones, such as Zone 2 (including Stratford and Battersea) and Zone 3 (including Lewisham and Wembley), offer lower rent options while maintaining excellent transport links to central London universities.

| Location | Average Monthly Rent (£) | Notes |

|---|---|---|

| Central London (Zones 1-2) | £900 – £1,600 | High demand, premium pricing, less commute time |

| Outer Zones (3-6) | £500 – £1,000 | More affordable, longer travel times |

| Popular Student Areas (e.g., Bloomsbury, Stratford) | £700 – £1,300 | Good balance of cost, convenience, and amenities |

2. Cost Of Studying In London

The universities in London are among the world’s leading institutions, attracting students from across the globe. The cost of studying in London varies depending on the course and level of study, as well as lifestyle choices for living expenses.

a. Undergraduate Courses

A student pursuing an undergraduate degree in London should expect annual tuition fees to range between £15,000 and £30,000. Additionally, student living costs in London typically range from £1,300 to £1,800 per month, depending largely on accommodation and personal spending habits.

| Course Type | Annual Tuition Fee (£) | Monthly Living Cost (£) |

|---|---|---|

| Arts & Humanities | £15,000 – £25,000 | £1,300 – £1,800 |

| Science/Engineering | £18,000 – £28,000 | £1,300 – £1,800 |

| Business/Economics | £16,000 – £30,000 | £1,300 – £1,800 |

| Medicine | £25,000 – £35,000 | £1,600 – £2,000 |

b. Postgraduate Courses

Postgraduate fees in London typically range from £16,000 to £35,000 per year. Additional costs for research, materials, and fieldwork may add to living expenses.

| Course Type | Annual Tuition Fee (£) | Monthly Living Cost (£) |

|---|---|---|

| Arts/Social Sciences | £16,000 – £30,000 | £1,300 – £1,800 |

| Engineering/IT | £18,000 – £33,000 | £1,300 – £1,800 |

| Business/Finance | £20,000 – £35,000 | £1,400 – £1,900 |

| Medicine/Public Health | £25,000 – £35,000 | £1,600 – £2,000 |

c. PhD Courses

PhD tuition fees vary by university and project but generally range between £18,000 and £35,000 per year. Living costs remain consistent, though research-related travel or material costs may increase overall expenditure.

| Study Level | Annual Tuition Fee (£) | Monthly Living Cost (£) |

|---|---|---|

| PhD | £18,000 – £35,000 | £1,300 – £2,000 |

3. Cost Of Food In London

Food costs form an essential part of living expenses for students in London. From vibrant street markets to large supermarket chains, prices can vary, yet there are plenty of budget-friendly options for those willing to explore.

Many students enjoy shopping at local markets for fresh produce and pantry staples, allowing them to prepare meals at home and save money.

Below is a table showing typical grocery prices to give an idea of what students might spend on food each month:

| Item | Price Range (£) |

|---|---|

| Milk (1 litre) | £0.85 – £1.89 |

| Fresh White Bread (500g) | £0.75 – £4.00 |

| White Rice (1kg) | £1.00 – £3.00 |

| Eggs (12) | £2.10 – £5.60 |

| Local Cheese (1kg) | £3.50 – £17.50 |

| Chicken Fillets (1kg) | £3.20 – £10.00 |

| Beef Round (1kg) | £5.00 – £24.70 |

| Apples (1kg) | £1.00 – £4.00 |

| Bananas (1kg) | £0.90 – £3.00 |

| Oranges (1kg) | £1.00 – £5.00 |

| Tomatoes (1kg) | £1.00 – £5.00 |

| Potatoes (1kg) | £0.70 – £2.00 |

| Onions (1kg) | £1.00 – £2.00 |

| Lettuce (1 head) | £0.79 – £1.99 |

| Water (1.5 litre bottle) | £0.66 – £2.00 |

Tips To Save On Groceries

- Shop at Local Markets

Local markets often have fresher, seasonal produce at much lower prices than supermarkets. Shopping early in the day or just before closing can bring additional discounts on perishable items.

- Buy in Bulk

Stocking up on non-perishable items like rice, pasta, and canned goods can reduce the per-unit price and minimise frequent trips, saving time and money. Look out for bulk deals, but only buy what you realistically need to avoid waste.

- Use Discount Supermarkets

Chains like Aldi and Lidl are known for quality products at lower costs. These supermarkets often run weekly specials and have their own brands, which are budget-friendly and of great quality.

- Look for Special Offers and Discounts

Many supermarkets offer loyalty cards that accumulate points redeemable for discounts or free items. Signing up for student discount schemes or using coupons can further reduce costs.

- Plan Your Meals

Mapping out your meals for the week helps create focused shopping lists and prevents impulse purchases. This method also reduces food wastage by using ingredients efficiently across multiple meals.

- Cook at Home

Cooking homemade meals not only saves money but also allows you to control the nutrition and portions of your food. Preparing meals in bulk and freezing portions can save both time and energy during busy study periods.

- Choose Seasonal Produce

Fruits and vegetables in season are more abundant, fresher, and usually much cheaper. Plus, incorporating seasonal foods adds variety and nutritional benefits to your diet.

- Use Cashback and Voucher Apps

Apps like Honey, Shopmium, and Groupon offer cashback or discount vouchers. Regularly checking these can lead to significant savings over time without much effort.

4. Cost Of Dining Out In London

Eating out in London can be a delightful experience, offering a variety of cuisines from around the world. For students, dining out can quickly become expensive, but with a bit of savvy planning, it’s still possible to enjoy meals out without overspending.

Many restaurants in London offer student discounts or special deals during weekdays and off-peak hours, making it easier to enjoy eating out occasionally without significantly impacting your London student living costs.

| Meal Type | Price Range (£) |

|---|---|

| Meal, Inexpensive Restaurant | £13.00 – £30.00 |

| Meal for 2, Mid-range Restaurant | £60.00 – £120.00 |

| McMeal at McDonalds (or Equivalent) | £7.43 – £10.00 |

5. Cost Of Transportation In London

Getting around London as a student is convenient, thanks to the extensive transport network, including buses, the Tube,

Overground trains, and taxis. While transport costs can add up, students benefit from various discounts like the 18+ Student Oyster photocard, which offers around 30% off standard fares across most public transport in London.

| Transport Type | Price Range (£) |

|---|---|

| One-way Ticket (Local Transport) | £2.00 – £4.00 |

| Monthly Pass (Regular Price) | £107.39 – £228.26 |

| Taxi Start (Normal Tariff) | £3.28 – £6.00 |

| Taxi 1km (Normal Tariff) | £1.00 – £3.73 |

6. Cost Of Utilities In London

Utilities are a necessary monthly expense for students living in London. These include essential services like electricity, heating, water, and garbage collection, whose costs vary depending on usage and apartment size. Shared student housing can help split the costs of the utilities, thereby reducing costs.

| Utility Type | Price Range (£) |

|---|---|

| Basic Utilities (Electricity, Heating, Cooling, Water, Garbage) | £159.38 – £442.00 |

| Mobile Phone Plan (Calls + 10GB Data) | £8.00 – £35.00 |

| Internet (60 Mbps or More, Unlimited Data) | £25.00 – £45.00 |

When you book with UniAcco, you don’t need to worry about utility bills – our accommodation rents include all essential utilities like electricity, water, heating, and high-speed Wi-Fi, so you can enjoy hassle-free living with no surprise costs.

7. Cost Of Fitness and Leisure In London

Keeping fit and enjoying leisure activities is important for students in London. Gym memberships vary widely, with options ranging from affordable gyms offering basic facilities to premium clubs with additional amenities. Renting tennis courts is a popular sporting activity available at reasonable hourly rates. For entertainment, cinema tickets for new releases provide an accessible way to relax and enjoy London’s vibrant cultural scene.

| Activity | Price Range (£) |

|---|---|

| Fitness Club, Monthly Fee | £28.00 – £90.00 |

| Tennis Court Rent (1 Hour) | £11.50 – £30.00 |

| Cinema Ticket (International Release) | £10.00 – £19.00 |

Want to save on living costs? Explore affordable student accommodations in London now!

Why Knowing the Cost of Living in London Matters for Students?

- Plan Your Budget Smartly – Knowing typical living costs (£1,300–£2,000/month) helps you balance rent, food, transport, and essentials without financial stress.

- Avoid Surprises – London rent alone averages £300–£350/week. Researching costs ahead prevents unexpected expenses from disrupting your studies.

- Support for International Students – Currency fluctuations, bank charges, and unfamiliar financial systems can impact finances. Advance planning reduces stress and ensures smoother money management.

- Lifestyle Choices Affect Spending – Accommodation type (university halls, PBSA, shared flats, private apartments) and lifestyle habits (eating out, social activities, transport, gym) directly influence your budget.

- Make Smarter Decisions – Awareness allows for practical choices like cooking at home, using student travel cards, or picking affordable areas—letting you enjoy London without overspending.

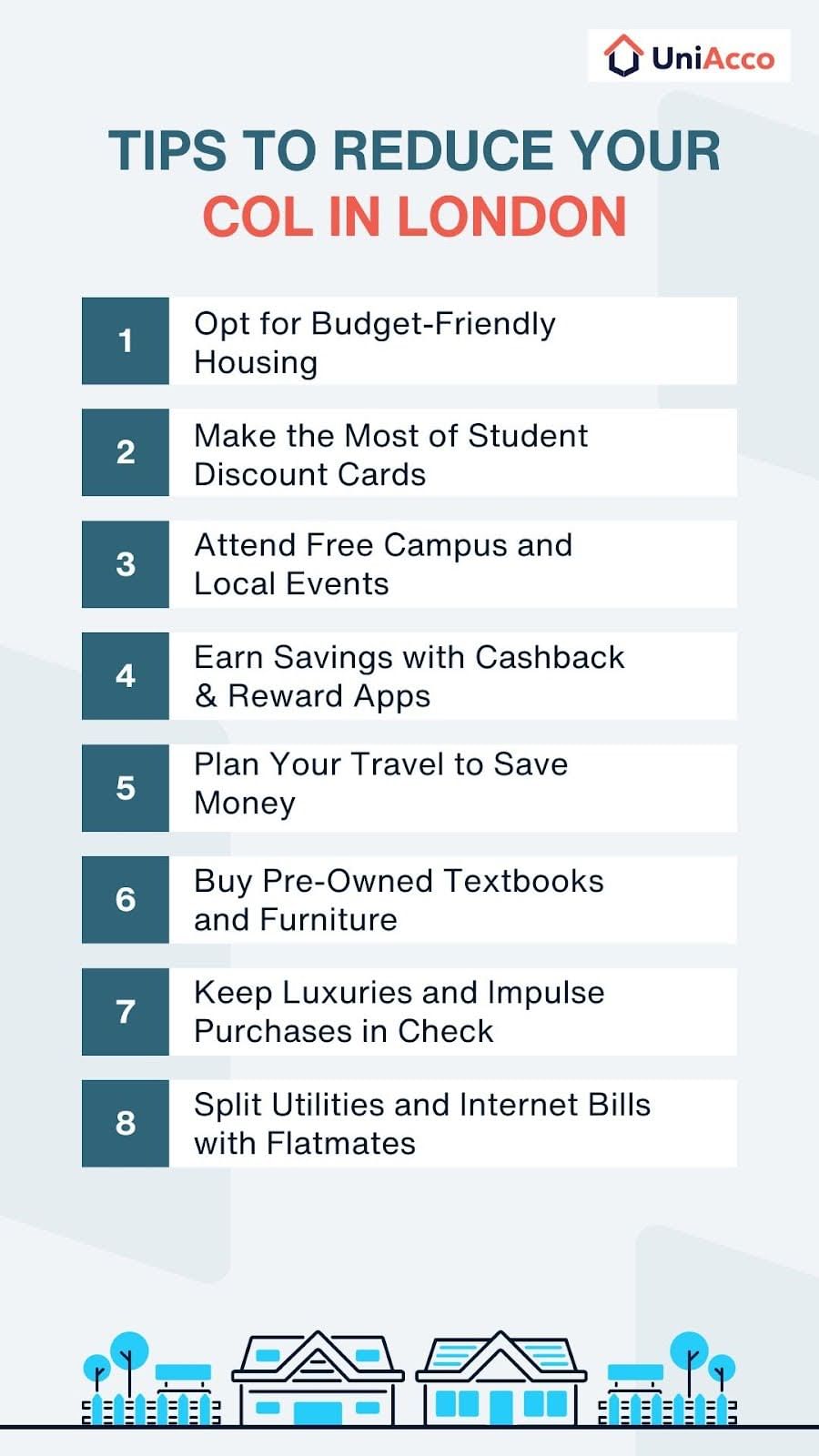

Hacks To Cut Down The Cost of Living in London

- Choose Affordable Accommodation

Opting for shared flats or student residences outside central London zones can drastically reduce rent and utility bills. Living further from the city centre often comes with better value for money, and good public transport links still make commuting manageable.

- Use Student Discount Cards

Always carry an 18+ Student Oyster card for reduced travel fares. Additionally, use student discount platforms and apps like UNiDAYS or Student Beans, which offer deals on food, clothes, entertainment, and digital services.

- Take Advantage of Free Events

Universities and community groups regularly host freebies like food socials, workshops, and cultural events. These offer opportunities to save on meals, entertain yourself, and meet new people without spending money.

- Utilise Cashback and Reward Apps

Cashback apps like Quidco or TopCashback and reward programmes linked to grocery stores can add up to notable savings over time, especially when aligned with regular shopping or travel expenses.

- Plan Travel Smartly

Consider walking or cycling for short distances to save on transport. For longer journeys, purchase monthly or annual travel passes, and plan trips during off-peak hours. Avoid single, last-minute tickets which tend to be more expensive.

- Buy Second-hand Textbooks and Furniture

Use online marketplaces, university noticeboards, or charity shops for affordable books and household items. Buying pre-loved essentials is kinder on the wallet and a sustainable choice.

- Limit Luxuries and Impulse Spending

Track spending to identify and reduce expenses on daily luxuries such as frequent coffee shop visits, eating out, or fast fashion purchases. Setting weekly or monthly spending limits helps develop financial discipline.

- Share Utilities and Internet Costs

Splitting the cost of utilities and internet among housemates can substantially reduce monthly expenses. Choosing unlimited broadband plans with reliable providers avoids unexpected charges and provides steady internet for studies.

Scholarships & Part-Time Jobs to Cover Living Expenses

| University | Scholarship Name | Amount (£) |

|---|---|---|

| University of East London | International Undergraduate Scholarship | £500 to £5,000 |

| Anglia Ruskin University | International Undergraduate Scholarship | £2,000 to £7,000 |

| Royal Holloway University London | Royal Holloway International Scholarship | Varies, up to full tuition |

| Brunel University London | GREAT Scholarship | Up to £10,000 |

| Chevening Scholarships | UK Government Scholarship | Full tuition + living costs |

Part-Time Jobs for Students in London

Many students in London take on part-time jobs to support themselves financially, gain valuable work experience, and develop new skills.

| Job Type | Hourly Pay Range (£) | Weekly Hours Allowed |

|---|---|---|

| Retail Assistant | £10 – £12 | Up to 20 (term time) |

| Barista/Café Staff | £10 – £12 + tips | Up to 20 (term time) |

| Tutor (Subject Expert) | £14 – £21 | Flexible |

| Library Assistant | £10 – £15 | Up to 20 (term time) |

| Customer Service Rep | £10 – £12 | Up to 20 (term time) |

| Administrative Support | £10 – £14 | Up to 20 (term time) |

| Research Assistant | £14 – £21 | Flexible |

| Freelance/Digital Work | £12 – £25 | Flexible |

International students holding a Tier 4 or Student Route visa are typically allowed to work up to 20 hours per week during university term time if enrolled in a degree-level course or higher.

Outside term time, including vacations and breaks, students can work full-time without hourly restrictions. This allows them to maximise earnings during these periods without conflicting with their studies.

Living in London as an international student presents a unique blend of exciting opportunities and higher living costs compared to other cities in the UK.

By carefully budgeting, utilising scholarships, and engaging in part-time work while adhering to visa regulations, students can realistically manage their expenses without compromising their academic goals.

Thoughtful choices around accommodation, food, and transport, combined with solid financial planning, enable students to maintain a comfortable lifestyle while focusing on their studies.

Securing student accommodation in London with UniAcco can further simplify this experience. Offering a range of fully furnished, budget-friendly options in prime locations near supermarkets and transport links, we help students find homes that suit both their needs and budgets.

0 Comments