The world of investing is no longer reserved for professionals with large sums of money. Today, students in India are becoming increasingly interested in trading apps as a way to learn, invest small amounts, and even build a foundation for long-term wealth. With plenty of platforms available in 2025, the challenge is not in finding an app but in knowing which app is best for trading for students.

This blog takes a comprehensive look at the top 10 trading apps in India for students. Each app balances ease of use, cost, features, and accessibility, making them friendly for beginners or first-time investors.

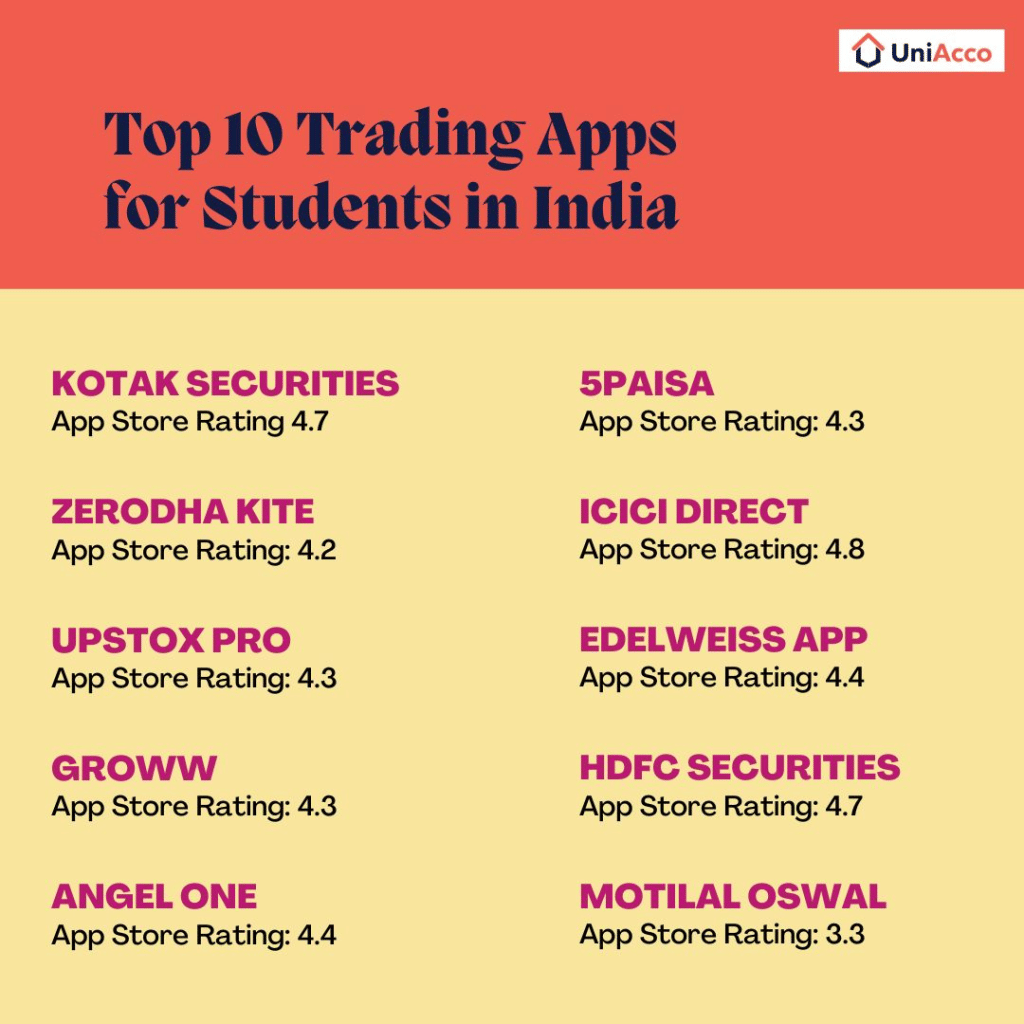

Quick Comparison of Top Trading Apps for Students

| App Name | Brokerage Fees per Trade | Account/AMC Charges | Rating (App Store) |

| Kotak Securities | Zero brokerage on intraday | Zero AMC | 4.7 |

| Zerodha Kite | Flat ₹20 or 0.03% | ₹300 AMC after 1 yr | 4.2 |

| Upstox Pro | ₹20 per trade | Free first year | 4.3 |

| Groww | Zero brokerage on equity delivery | No AMC | 4.3 |

| Angel One | ₹20 per trade cap | Low brokerage | 4.4 |

| 5paisa | ₹20 per trade | ₹300 AMC | 4.3 |

| ICICI Direct | ₹20 per trade | AMC as per plan | 4.8 |

| Edelweiss App | Flat ₹10 intraday | Reasonable charges | 4.4 |

| HDFC Securities | ₹20 per trade | ₹750 AMC | 4.7 |

| Motilal Oswal | ₹20 or 0.02% | Charges apply | 3.3 |

10 Best Trading Apps in India for Students

Kotak Securities

Kotak Securities is one of India’s most reliable brokers, backed by Kotak Mahindra Bank. It offers a secure platform with strong brand trust, making it a safe first step for students. Its intuitive design allows beginners to grasp trading quickly while exploring multiple investment choices under one roof.

Ratings

- Google Play Store: 4.2/5

- Apple App Store: 4.7/5

Key Features

- Lifetime free demat account with zero maintenance fees.

- Simple interface for smooth trading and investing.

- Access to stocks, ETFs, IPOs, and mutual funds.

- Educational resources for young investors.

Pros and Cons

| Pros | Cons |

| Free demat account for life | Limited advanced research tools on mobile |

| Beginner-friendly onboarding | Occasionally slower app performance |

| Wide investment variety | Limited technical analysis features for experienced users |

| Educational support included | Customer support can sometimes delay |

Fees Involved

Zero account-opening charges and annual maintenance fees (AMC) often start at ₹0 for the first year and range from ₹300 to ₹500 thereafter, with brokerage typically charged at ₹20 per trade or 0.05% of the trade value, making it affordable for students with many student-friendly plans available.

Kotak Securities is a cost-effective investment app for students, making it easy to start with low financial pressure.

Zerodha Kite

Zerodha Kite is India’s pioneer in discount broking, known for bringing affordable trading to millions. Its blend of simplicity and advanced charting tools makes it equally appealing for new traders and those looking to experiment with analysis gradually. For students, it strikes a balance between learning and affordability.

Ratings

- Google Play Store: 4.5/5

- Apple App Store: 4.2/5

Key Features

- Flat brokerage capped at ₹20 per trade.

- Minimalist yet powerful interface.

- Advanced charts and technical indicators.

- Comprehensive learning through Zerodha Varsity.

Pros and Cons

| Pros | Cons |

| Affordable, flat brokerage | Annual maintenance fee after first year |

| Clean and simple design | No direct banking integration |

| Feature-rich with advanced tools | Steeper learning curve for beginners |

| Best educational ecosystem | No physical branches for face-to-face support |

Fees Involved

Brokerage: ₹20 or 0.03% per order. Account AMC: ₹300 yearly after 1st year.

Zerodha Kite is the best trading app for students, offering low-cost trades with easy-to-learn tools.

Upstox Pro

Upstox Pro is a fast, modern investment platform backed by strong financial investors. It is designed for quick order placement and smooth execution, making it ideal for young traders balancing academics with market activity. Students will find it convenient to explore markets on the go.

Ratings

- Google Play Store: 4.3/5

- Apple App Store: 4.3/5

Key Features

- Flat ₹20 brokerage per trade.

- Lightning-fast order placement.

- Wide range of products: stocks, derivatives, MFs, IPOs.

- Advanced charting with over 100 indicators.

Pros and Cons

| Pros | Cons |

| Affordable brokerage | Customer service can be slow |

| Quick execution speed | Limited in-app educational resources |

| Supports stocks/derivatives/IPO | Occasional app crashes reported |

| Regular app improvements | Lacks extensive research tools |

Fees Involved

₹20 flat per trade. Free account-opening offers are often available for students.

Upstox Pro is one of the top 10 trading apps in India, perfect for students who want speed and simplicity.

Groww

Groww has evolved from a mutual fund platform into a comprehensive investment app with a strong appeal to students. Its clean interface makes it extremely easy to understand, even for those opening their first trading account. Students benefit from flexible product choices that suit both short-term learning and long-term investing.

Ratings

- Google Play Store: 4.6/5

- Apple App Store: 4.3/5

Key Features

- Zero brokerage on delivery trades.

- Clean, clutter-free interface.

- Invest in mutual funds, ETFs, and stocks.

- In-app blogs and guides to learn the basics.

Pros and Cons

| Pros | Cons |

| Zero brokerage on delivery | Lacks advanced charting tools |

| Simple design for beginners | Limited derivative trading options |

| Wide range of market products | No direct physical support |

| Trusted by mutual fund investors | Some delays in customer support response |

Fees Involved

No delivery brokerage. Intraday/ derivative charges are extra at market rates.

Groww is the best app for investment in India for students who want simplicity and trust.

Angel One

Angel One brings together decades of experience and modern mobile-first tools, making financial markets accessible to first-time investors. With its smart recommendations and focus on research, it can help students not only invest but also understand why certain investments matter.

Ratings

- Google Play Store: 4.4/5

- Apple App Store: 4.4/5

Key Features

- ₹20 capped brokerage per trade.

- Smart stock recommendations.

- Access to stocks, IPOs, commodities, and mutual funds.

- Rich research features.

Pros and Cons

| Pros | Cons |

| Affordable brokerage | Can feel heavy on low-end smartphones |

| Stock suggestions & advice | User interface can sometimes feel cluttered |

| Wide market coverage | Occasional glitches during high traffic |

| In-depth research included | Limited video tutorials and educational content |

Fees Involved

₹20 per trade with affordable account-open plans.

Angel One is one of the best trading apps for students, combining guidance with flexibility.

5paisa

5paisa is built for affordability and simplicity, making it a popular choice among young traders with tight budgets. It provides robo-advisory features that help students make informed choices, reducing the stress of early investing mistakes.

Ratings

- Google Play Store: 4.1/5

- Apple App Store: 4.3/5

Key Features

- Flat ₹20 brokerage on trades.

- Robo-advisory features for new investors.

- Quick single-click order execution.

- Paid plans for premium tools.

Pros and Cons

| Pros | Cons |

| Very cheap brokerage | Limited features in free plan |

| Robo-advisory available | Customer support limited during peak times |

| Easy, fast trading | Premium features require paid subscription |

| Market research support | Learning content is basic |

Fees Involved

₹20 per order. Subscription plans are optional.

5paisa stands out among the best earning apps for students without investment, thanks to its low-cost plans and robo-advisory support.

ICICI Direct

ICICI Direct is among the most trusted full-service brokers in India, directly tied to ICICI Bank. For students, it offers the extra confidence of a secure, established financial institution while still delivering a wide variety of investment options.

Ratings

- Google Play Store: 4.0/5

- Apple App Store: 4.8/5

Key Features

- Linked with ICICI Bank for smooth funds.

- Wide range of investment choices, from equities to fixed deposits.

- Student-friendly discounted plans available.

- Research-backed suggestions.

Pros and Cons

| Pros | Cons |

| Trusted name in finance | Higher AMC charges |

| Bank-linked reliability | Relatively costly brokerage fees |

| Good research support | User interface may seem outdated |

| Covers equities, IPOs, FDs | Less competitive for purely digital-first investors |

Fees Involved

Brokerage at ₹20 per order. Plus AMC charges on certain plans.

ICICI Direct is a trusted trading app for students, offering both security and choice.

Edelweiss App

The Edelweiss App combines modern design with expert-backed research suited for balanced investors. Students find it appealing because it offers professional-grade tools without being too complex, striking a good mix between usability and depth.

Ratings

- Google Play Store: 4.1/5

- Apple App Store: 4.4/5

Key Features

- Flat ₹10 brokerage for intraday.

- Research-driven trade recommendations.

- Balanced for both simple and advanced investors.

- Insightful reports and market updates.

Pros and Cons

| Pros | Cons |

| Very affordable brokerage | Slow onboarding sometimes |

| High-quality reports | Some features less intuitive for beginners |

| Balance of simplicity & tools | Occasional app update issues |

| Guidance-driven interface | Limited customer support hours |

Fees Involved

₹10 per intraday trade, delivery and derivative fees as per terms.

Edelweiss is one of the best investment apps for students, delivering learning and enabling safer investing opportunities at affordable rates.

HDFC Securities

HDFC Securities is a secure platform from one of India’s most trusted banks. It appeals to students looking for stability and convenience, offering direct bank account integration and access to multiple investment choices beyond equities.

Ratings

- Google Play Store: 4.0/5

- Apple App Store: 4.7/5

Key Features

- Seamless integration with HDFC Bank accounts.

- Multiple investment choices: stocks, IPOs, FDs, mutual funds.

- Reliable customer support.

- Strong research offerings.

Pros and Cons

| Pros | Cons |

| Secure and bank-integrated | Higher AMC and brokerage fees |

| Wide market variety | Steeper learning curve for beginners |

| Reliable brand support | Limited app customisation |

| Good research insights | Less flexible for budget-conscious users |

Fees Involved

₹20 per order brokerage. AMC charges of ~₹750 applicable.

HDFC Securities is a strong investment app for students, valued for its secure ecosystem.

Motilal Oswal

Motilal Oswal is a seasoned broking name with a research-first approach. The app gives students easy access to quality investment advice, portfolio tools, and SIP features that help them invest systematically while learning market fundamentals.

Ratings

- Google Play Store: 4.2/5

- Apple App Store: 3.3/5

Key Features

- Flat brokerage at ₹20 per order.

- Sector-wise reports and expert advice.

- Auto-invest features and SIPs for consistency.

- Comprehensive portfolio tracking.

Pros and Cons

| Pros | Cons |

| Affordable charges | More suited to semi-experienced users |

| Extensive research tools | Heavier app, slower on low-spec devices |

| Includes auto-invest & SIPs | UI can overwhelm beginners |

| Excellent portfolio tracking | Customer support not always prompt |

Fees Involved

₹20 per order or 0.02% of value. Standard AMC charges apply.

Motilal Oswal is part of the top 10 trading apps in India, perfect for students who want to invest with strong research backing.

Also read: You Must Follow These 10 Ways To Save Money As A Student

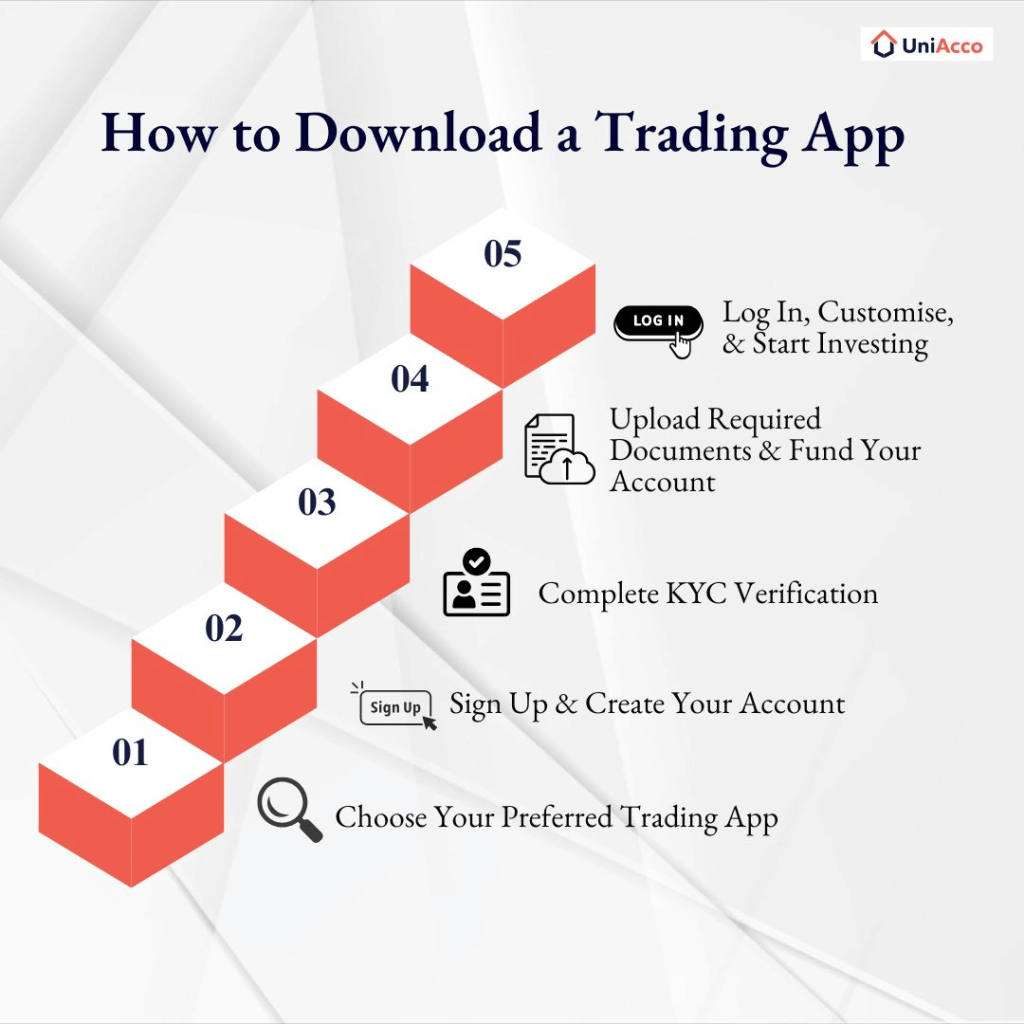

Step-by-Step Guide to Download a Trading App

Step 1: Choose Your Preferred Trading App

Choose your preferred broker (e.g., Zerodha, Groww, Upstox) and download their official trading app from the Google Play Store or the Apple App Store.

Step 2: Sign Up and Create Your Account

Sign up with your Aadhaar-linked mobile number and create your User ID and password. Keep your PAN card, Aadhaar, and bank account details handy.

Step 3: Complete Your KYC Verification

Enter the required personal details online and complete the e-KYC process. You will receive an OTP on your registered mobile number for verification.

Step 4: Upload Required Documents and Fund Your Account

Upload scanned copies or images of documents directly within the app. Some apps may charge account opening or annual fees at this stage, while others offer free student accounts.

Here’s a list of documents you’ll be required to keep ready:

| Document Type | Examples | Notes |

| Proof of Identity | PAN card (mandatory), Aadhaar card, Passport, Voter ID, Driving licence | PAN is compulsory for all trading accounts. |

| Proof of Address | Aadhaar, Passport, Voter ID, Bank statement, Cancelled cheque, Utility bills (electricity/landline, < 3 months old) | Must match your registered address. |

| Bank Proof | Cancelled cheque with name, Bank statement/passbook, Online bank confirmation | Required to link payments and settlements. |

| Additional Documents (rare) | Income proof (salary slips, ITR, bank statements) – for derivatives trading, Lease/rent agreement, Passport-size photo, Signature on paper | Usually not needed for basic equity accounts. |

Step 5: Log In, Customise, and Start Investing

After successful verification, log in with your new credentials. You can personalise your watchlist, explore stocks or mutual funds, and begin your investment journey.

Also Read: How To Have A Good University Life On A Small Budget?

Key Tips For A Successful Investment Journey

- Set Clear Investment Goals: Define what you want to achieve with your investments. For students, it’s helpful to focus on long-term goals like saving for education, building an emergency fund, or planning future expenses. Setting goals guides how you allocate your funds wisely.

- Diversify Your Portfolio: Don’t put all your money in one place. Spreading your investments across different sectors and asset types reduces risk and smooths out market ups and downs. Diversification is a key strategy to protect and grow your money over time.

- Understand the Risks: Every investment carries some degree of risk, and returns are never guaranteed. More volatile assets like individual stocks can offer higher rewards but come with greater risks. Your risk tolerance should align with your personal goals and comfort level.

- Keep Fees Low: Fees and charges can gradually reduce your investment returns. Look for brokerages and investments with low costs to maximise your potential gains over the long term.

Also read: Financial Advice For University Students

Trading Mistakes Students Need to Avoid

- Understand Market Fluctuations: Markets naturally go up and down in the short term; emotional reactions can harm your portfolio’s growth.

- Avoid Panic Selling: Selling during downturns often locks in losses and prevents recovery.

- Don’t Overtrade: Excessive trading based on speculation wastes time, increases risks, and raises transaction fees.

- Focus on Long-Term Growth: Choose well-researched investments with strong potential for steady returns.

- Adopt a Buy-and-Hold Strategy: Holding investments for years reduces the impact of volatility and benefits from compounding growth.

Also read: A Complete Beginner’s Guide On How To Invest As A Student

Students today don’t have to wait until employment to explore investing. With these top 10 trading apps in India, they can easily start building financial knowledge and small portfolios. Choosing the best trading app for students often comes down to balancing usability, fees, and reliability. Whether it’s Groww for mutual funds, Zerodha Kite for simplicity, or Kotak Securities with free account options, the opportunities are wide open in 2025.

FAQs

Q1: Are trading apps safe for students to use?

Ans: Yes, reputed trading apps in India are regulated by SEBI and use robust encryption to protect user data and transactions, making them safe for students.

Q2: Can students have accounts on multiple trading apps?

Ans: Yes, students can open trading accounts on multiple platforms, but it’s advisable to start with one to understand trading before expanding. Managing too many accounts can be confusing.

Q3: Is it safe to link bank accounts with trading apps?

Ans: Trusted trading apps use secure protocols for banking integrations, so linking your bank account is safe. Always use official app versions and avoid sharing sensitive information elsewhere.

Q4: How can students protect themselves from trading fraud?

Ans: Stick to SEBI-registered brokers, avoid suspicious calls or messages, never share OTPs or passwords, and regularly monitor your account activity for any unusual transactions.

Q5: Does having multiple trading accounts affect tax filings?

Ans: Yes, all trading income across different accounts must be reported accurately in your income tax filings, regardless of how many platforms you use.

0 Comments