Planning to study abroad and worried about repaying your student loan later? Understanding how international student loan repayment works is crucial for managing your finances effectively after graduation. From grace periods and repayment plans to tips for avoiding default and managing payments from abroad, this guide clearly breaks it all down. Whether you are taking out a loan for the U.S., UK, or elsewhere, this blog provides you with practical, actionable insights to help you stay financially prepared.

Step-by-Step Student Loan Repayment Process

Repaying a student loan might feel overwhelming at first, but understanding the process makes it much more manageable. From the moment your loan is disbursed to when you finally make the last payment (or qualify for forgiveness), there’s a clear journey you will follow. Here’s a step-by-step breakdown of what to expect at every stage of repayment.

Step 1: Loan Disbursement

- The loan is approved and disbursed to your university or directly to you (depending on the lender).

- Interest may begin accruing immediately (for most private loans and unsubsidised government loans).

Step 2: In-School Period

No EMI required yet (in most cases), but:

- Interest may accrue.

- Some loans require interest-only payments during this time.

- You can choose to make voluntary payments to reduce the interest burden later.

Step 3: Grace Period (Post-Graduation)

- A grace period of 6–12 months is provided after course completion, during which repayments do not begin.

- This allows time to find a job and establish a stable financial situation.

- Interest may continue to accrue during this time unless subsidised.

Step 4: Repayment Begins

- After the grace period, Equated Monthly Instalments (EMIs) or scheduled payments begin.

- You choose or are assigned a repayment plan:

- Standard Plan

- Income-Driven Plan

- Extended or Graduated Plan

- Monthly payments include both principal and interest.

Step 5: Making Payments

Payments can be made through:

- Bank transfers

- Online payment portals

- UPI/Auto-debit (for Indian lenders)

- International wire transfers (for foreign lenders)

- Auto-pay options often offer a small interest discount.

Step 6: Monitoring and Managing Your Loan

- Track loan balance, interest accrual, and payment history through your lender portal.

- Consider:

- Making extra payments toward the principal to reduce interest.

- Refinancing if you find better interest rates after securing a job.

- Loan consolidation if you have multiple loans.

- Deferment or forbearance if you face temporary financial difficulties.

Step 7: Completion or Forgiveness

Repayment continues until:

- The loan is fully repaid (typically 5–20 years).

- You qualify for loan forgiveness (e.g., Public Service Loan Forgiveness or income-driven repayment forgiveness after 20–25 years).

- In rare cases, loans may be discharged due to death or permanent disability.

Factors Determining How Much You Will Repay on Your Student Loan

Understanding what influences your student loan repayments is essential for planning your finances after graduation. The total amount you will repay isn’t just about the money you borrow; it’s shaped by factors like your interest rate, repayment term, plan type, and even currency fluctuations if you are repaying from abroad. By knowing these variables in advance, you can choose smarter repayment strategies and reduce the long-term cost of your education loan.

- Your Total Loan Amount

The most significant factor in how much you will repay is the loan amount you borrow. International student loans typically cover tuition fees, accommodation, insurance, and living expenses, resulting in a fairly substantial total loan amount. The higher your principal, the more you will pay each month and in total, unless you offset it with shorter repayment terms or early payments.

- Interest Rate Type: Fixed vs. Variable

Your interest rate directly affects the cost of borrowing. A fixed interest rate means your EMI remains consistent throughout the loan term, providing you with financial predictability. A variable rate, however, may fluctuate with market conditions, which can make long-term repayment less predictable. Even a slight 1% difference in your rate can translate into lakhs of rupees saved or spent over time.

- Loan Tenure or Repayment Term

The repayment tenure, or the length of time it takes to repay the loan, has a significant impact. A shorter tenure means higher monthly payments but lower total interest, while a longer tenure lowers your monthly EMI but increases the total repayment amount due to prolonged interest accumulation. Choosing a repayment term that aligns with your earning potential is crucial for managing costs effectively.

- Type of Repayment Plan

Your repayment plan also determines your monthly cash outflow. Under a standard plan, your EMI is fixed. A graduated plan starts low and increases over time, which is ideal if you expect salary growth. If you are in the U.S, income-driven repayment plans (IDR) like IBR, PAYE, REPAYE, and SAVE adjust your EMI based on your income and family size, but they often extend your loan term, resulting in more interest paid in total.

- Grace Period and Interest Accrual

Most lenders offer a grace period of 6 to 12 months post-graduation before you begin making payments. While this offers breathing room, interest often continues to accrue during this period. If you don’t pay it off, this interest is added to the principal, a process called capitalisation, which raises the total amount you will repay.

- Additional Costs and Currency Fluctuations

Loan repayment isn’t just about EMIs; there are hidden costs like processing fees, currency conversion charges, and late payment penalties. For students repaying loans from another country, currency exchange rates can also affect the effective EMI. A weakening home currency can inflate your monthly repayment if you’re earning in a different currency.

- Prepayments and Extra EMI Contributions

If your financial situation improves, making extra payments or prepaying your loan can reduce both the loan tenure and the total interest paid. Even paying a few thousand rupees extra every month can help you close your loan years in advance and save a substantial amount on interest.

Also Read: Can You Use Student Loans to Pay Rent? Everything You Need to Know

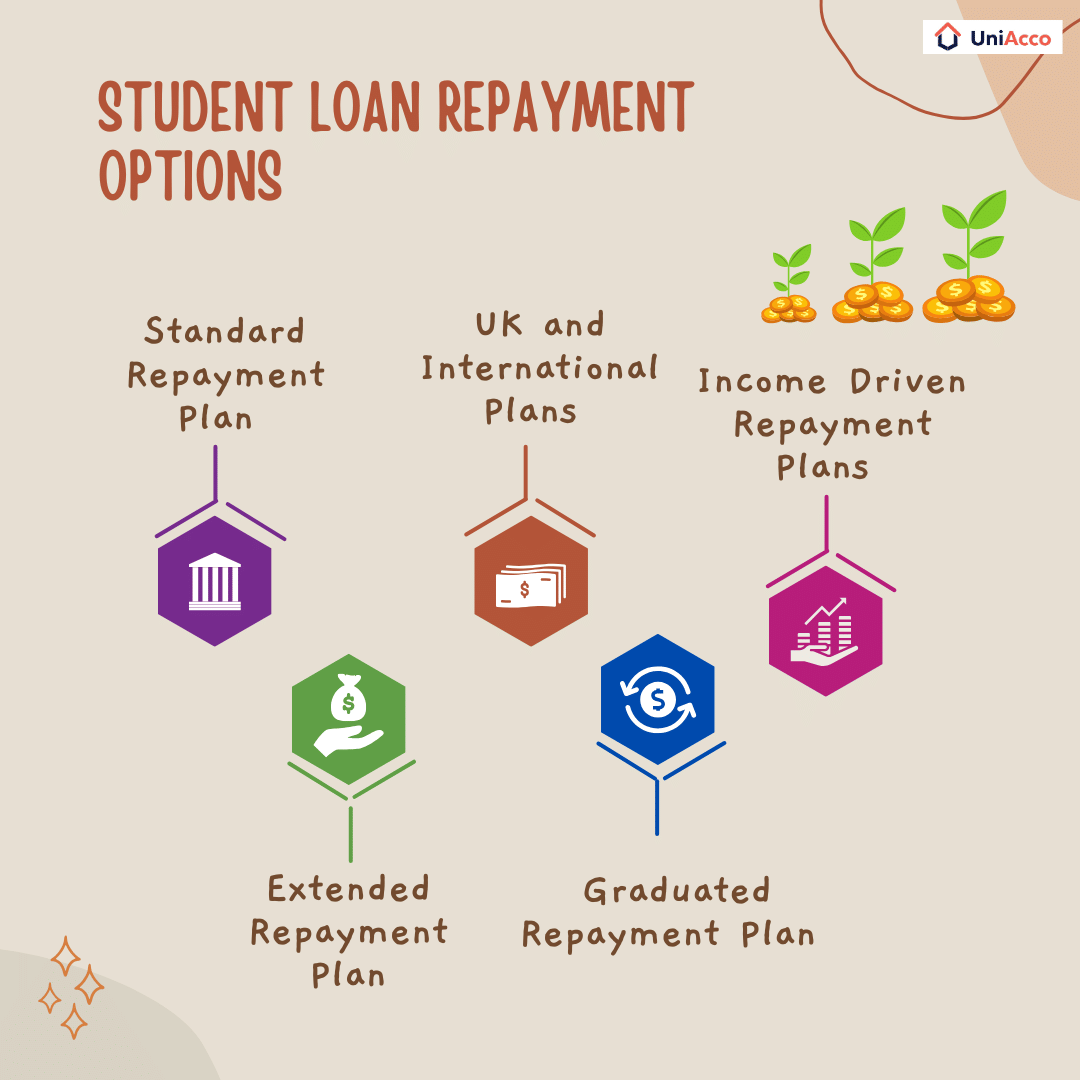

Understanding the Different Repayment Plans

Student loan repayment plans are designed to match different financial situations. Depending on your loan type, income, and when you borrowed, you may have several options, ranging from fixed payments to income-based plans.

Repayment plans vary by country and lender, but most fall under these categories:

| Repayment Plan | Key Features | Best For |

| Standard Repayment Plan | – Fixed monthly payments- Duration: 10–25 years- Less interest overall | Students with a steady post-graduation income |

| Extended Repayment Plan | – Repayment over 20–30 years- Lower monthly payments- More total interest | Borrowers with high loan balances |

| Graduated Repayment Plan | – Starts low, increases every 2 years- Payments grow with income | Students expecting salary growth |

| UK Repayment Plans | – Based on Plan 1, 2, 4, or Postgraduate Loan- Income threshold-based- Automatic deductions from salary | Students studying in the UK or taking UK student loans |

| Income-Driven Repayment (IDR) Plans – US | – Payments based on income and family size- Types: IBR, ICR, PAYE, REPAYE, SAVE- Loan forgiveness after 20–25 years | Borrowers seeking affordable monthly payments and forgiveness options |

How International Student Loan Repayments Are Made?

International student loan repayments usually begin after your course ends and the moratorium (grace) period, which typically lasts 6 to 12 months. During this period, full EMIs aren’t required, but interest may still accrue.

Repayments are primarily made via Equated Monthly Instalments (EMIs), which are fixed or gradually increasing payments, depending on your repayment plan.

Common Repayment Methods:

- Online Payments: Convenient payments through internet banking, UPI apps, or debit/credit cards.

- Automated Payments: Monthly payments are deducted automatically via ECS (Electronic Clearing Service) or NACH (National Automated Clearing House).

- Manual Payments: Some lenders still accept cheques or demand drafts, though these methods are becoming rare.

When and Why Do Student Loan Repayments End?

Student loan repayments typically cease when the loan is fully repaid, but certain conditions can also result in the suspension of payments or the forgiveness of the remaining balance. Here’s when repayments may stop:

1. Full Loan Repayment

- End of Loan Term: Once the full amount (principal and interest) is paid, repayments stop, and the loan is considered settled.

2. Loan Forgiveness Programmes

- Public Service Loan Forgiveness (PSLF): If you work in qualifying public service jobs, you may be eligible for loan forgiveness after making 120 qualifying monthly payments.

- Income-Driven Repayment Forgiveness: For those on income-driven repayment plans (IBR, PAYE, REPAYE), loan forgiveness may occur after 20-25 years of qualifying payments have been made.

- Teacher Loan Forgiveness: Teachers who work in low-income schools may have up to $17,500 in student loan debt forgiven.

Also Read: A Comprehensive Guide to Student Loan Forgiveness

3. Deferment or Forbearance

- Temporary Suspension: If you are going through financial hardship, continuing education, or facing another qualifying situation, you may apply for deferment or forbearance, temporarily halting repayments.

4. Death or Disability

- Disability: If you become permanently disabled, your loan may be discharged, meaning repayments will stop.

- Death: In case of the borrower’s death, the student loan is typically forgiven (for federal loans).

Tips for Managing Your Student Loan

Managing your student loan effectively can save you money and reduce stress. Here are some tips to help you stay on top of your repayments:

1. Set Up Automatic Payments

- Enroll in automatic payments to ensure you never miss a due date. Many loan servicers offer a small interest rate reduction for doing so.

2. Stay Organised

- Keep track of your loan balances, interest rates, and due dates. Set reminders or use budgeting apps to stay organised.

3. Consider Refinancing

- If your credit score improves, refinancing can help you secure a lower interest rate. This will lower your monthly payments and save money over the life of the loan.

4. Make Extra Payments

- Paying a little extra each month can help reduce your principal balance faster, ultimately saving you money on interest and shortening your loan term.

5. Use Income-Driven Repayment Plans (IDR)

- If you are struggling with monthly payments, an income-driven repayment plan can lower your payments based on your income and family size, making them more manageable.

6. Look for Loan Forgiveness Opportunities

- If you are eligible for forgiveness programmes (e.g., PSLF or teacher loan forgiveness), make sure you are meeting all requirements to have your loan discharged after a set number of years.

7. Refinance or Consolidate If Needed

- Consider consolidating multiple loans for easier management or refinancing for a better rate. Be aware of the pros and cons of consolidation before proceeding.

8. Review Your Budget Regularly

- Ensure that your loan payments align with your monthly budget. Adjust your spending habits as necessary to avoid skipping payments.

Also Read: Top 14 Best Ways To Pay Off Student Loans Quickly

Repaying an international student loan doesn’t have to be overwhelming. With the right plan, tools, and awareness of your options from grace periods to forgiveness programs, you can stay in control of your finances and confidently repay what you owe.

And while you are planning your academic future, don’t forget to sort your Student accommodation early too! Head to UniAcco to find verified, fully furnished student rooms in the UK at the best prices, because great living shouldn’t wait until the last minute.

FAQs

Q1. What is the standard repayment for student loans?

Ans: The standard repayment plan for student loans involves fixed monthly payments over a set period, usually 10 years. This plan ensures that both the principal and interest are paid off within this term, providing a predictable repayment schedule.

Q2. When do you start repaying?

Ans: Repayments typically begin after a grace period, which can range from 6 to 12 months following graduation. During this time, you may either pay only interest or defer payments entirely, depending on your loan terms.

Q3. Is an education loan interest-free?

Ans: No, education loans are not interest-free. Interest is typically charged on the loan amount from the disbursement date, with rates varying depending on the lender, loan type, and country.

Q4. How are student loan repayments deducted?

Ans: Student loan repayments are usually deducted through automatic bank transfers, where payments are automatically debited from your account each month. Alternatively, you can make manual payments via online banking or debit/credit cards, or in some cases, by cheque or demand draft.

0 Comments