Whether you are moving to the UK for work, study, or to start a new chapter in life, understanding the cost of living is necessary for planning your finances and setting realistic expectations. In 2025, everyday expenses like housing, food, transportation, and utilities will have seen noticeable shifts due to inflation, global economic changes, and regional disparities. From cities like London and Manchester to quieter towns and student hubs, the cost of living can vary widely based on lifestyle and location.

This blog provides comprehensive information on the cost of living in the UK, covering expenses such as rent, groceries, transportation, utilities, and more.

Average Cost Of Living In The UK In 2025

The cost of living in the UK varies significantly depending on factors such as the city of residence, accommodation expenses, and lifestyle choices. The table below provides an approximate monthly living cost in the UK for both a family of four and a single person.

| Category | Cost in Pounds (£) | Cost in Rupees (₹) |

| Family of Four (Monthly) | £2,900 | ₹348,000 |

| Cost of living in the UK per month for a single person | £1700 | ₹203,800 |

| Cost of living in the UK for International Students (Monthly) | £900 – £1400 | ₹107,970 – ₹167,958 |

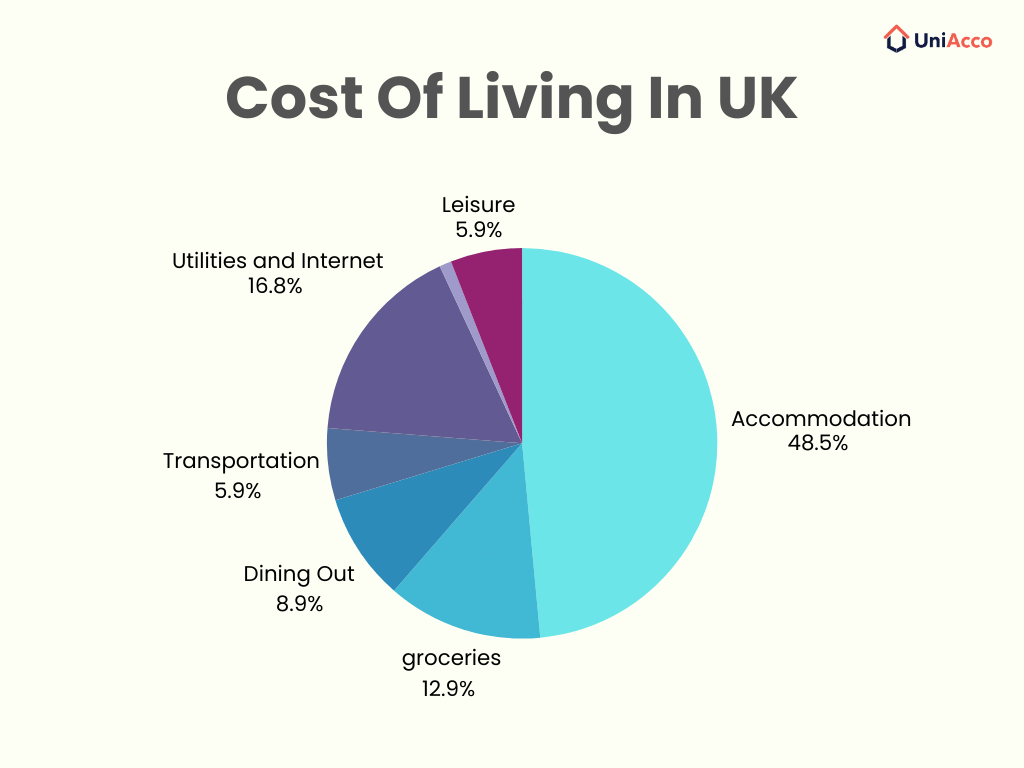

Detailed Breakdown Of Cost Of Living In The UK

The monthly cost of living in the UK for a single person is estimated to be around £1700. However, living expenses can vary significantly depending on numerous factors, such as location, accommodation type, lifestyle choices, and personal spending habits.

Major cities like London and Edinburgh typically have higher costs due to increased rent and living expenses, while smaller towns and rural areas may offer more affordable options.

- Costs Of Accommodations In The UK

The cost of accommodation in the UK can range anywhere between £600 to £4000 per month or even higher, depending on the location and the type of housing. In major cities like London, you can expect higher rent prices compared to other cities in the UK, while smaller cities and towns have relatively more affordable options.

The table below provides a detailed breakdown of average rental prices and the cost per square metre to buy an apartment.

| Category | Cost in Pounds (£) |

| Rent Per Month | |

| 1-bedroom apartment in the city centre | £1,015 |

| 1 bedroom outside the centre | £830 |

| 3-bedroom apartments in the city centre | £1,700 |

| 3-bedroom apartments outside the centre | £1,350 |

| Price Per Square Metre to Buy An Apartment | |

| In the City Centre | £4,510 |

| Outside of the Centre | £3,628 |

- Cost Of Groceries and Food In The UK

The UK has a wide range of supermarkets and grocery stores that cater to diverse tastes and budgets. From budget-friendly options like Aldi and Lidl to mid-range supermarkets such as Tesco, Sainsbury’s, and Asda, and high-end stores like Waitrose and Marks & Spencer, there’s a place for everyone to shop.

Grocery costs in the UK can vary by location, store, and personal preferences, but prices are generally consistent nationwide. On average, you can expect to spend around £200–£250 per month on groceries. Knowing the typical prices of staple items can help you manage your budget more effectively, whether you are shopping for yourself or a household.

| Item | Price (£) |

| Milk (regular), (1 litre) | £1 |

| Loaf of Fresh White Bread (500g) | £1 |

| Rice (white), (1kg) | £2 |

| Eggs (regular) (12) | £3 |

| Local Cheese (1kg) | £7 |

| Chicken Fillets (1kg) | £7 |

| Apples (1kg) | £2 |

| Banana (1kg) | £1 |

| Oranges (1kg) | £2 |

| Tomato (1kg) | £3 |

| Potato (1kg) | £1 |

| Onion (1kg) | £1 |

| Lettuce (1 head) | £1 |

| Water (1.5 litre bottle) | £1 |

| Bottle of Wine (Mid-Range) | £8 |

How To Save Money On Groceries In The UK?

Groceries can be one of the most significant expenses in a household budget, but with a few smart strategies, you can significantly reduce your spending. Here are some practical tips to help you save money on groceries in the UK.

- Plan Your Meals and Make a Shopping List: Avoid impulse buys and stick to what you need.

- Take Advantage of Discounts and Offers: Use loyalty cards (Tesco clubcard, Nectar Sainsbury’s) and apps (Groupon and student beans), to find the best deals.

- Buy in Bulk: Purchase larger quantities of long-lasting items like rice and pasta for better value.

- Reduce Food Waste: Plan meals around what you already have, store food properly, and use leftovers creatively.

Also Read: Best Hacks For Shopping For Groceries On A Budget As A Student

- Cost Of Dining Out In The UK

Understanding food expenses in the UK means balancing everyday grocery shopping with occasional dining out. From traditional pubs to international restaurants, the UK offers a diverse culinary scene. On average, you can expect to spend around £100–£200 per month on takeaways and dining out. Being aware of these costs can help you manage your budget effectively while still enjoying good meals.

| Item | Price (£) |

| Meal, Inexpensive Restaurant | £15 |

| Meal for 2 People, Mid-range Restaurant, Three-course | £65 |

| McMeal at McDonald’s (or Equivalent Combo Meal) | £8 |

| Domestic Beer (0.5 litre draught) | £5 |

| Imported Beer (0.33 litre bottle) | £5 |

| Cappuccino (regular) | £4 |

| Coke/Pepsi (0.33 litre bottle) | £2 |

| Water (0.33 litre bottle) | £1 |

- Cost Of Transportation In The UK

Transportation costs in the UK can range from £50 to £200 per month, depending on your location and travel method. Public transport is widely used and reliable, especially in major cities like London, where monthly costs are higher. Outside London, travel tends to be more affordable. Whether you rely on buses, trains, or drive a car, understanding typical transport expenses is key to managing your budget. Here’s a quick overview of common transportation costs across the UK:

| Category | Cost in Pounds (£) |

| Buses (One way) | £1.75 – 3 |

| Monthly Pass (Regular Price) | £70 – £100 |

| Taxi Start (Normal Tariff) | £4 |

| Taxi 1 hour Waiting (Normal Tariff) | £17 |

- Utility Costs In The UK

Planning your budget thoroughly involves understanding and anticipating all monthly utility expenses you might incur. These essential utility bills encompass a range of services, including electricity, water, heating, mobile phone charges, and other related expenses. Being aware of these costs allows you to manage your finances effectively and ensure that you allocate funds appropriately.

| Category | Cost in Pounds (£) Monthly |

| Basic Utilities (Electricity, Heating, Cooling, Water, and Waste services) | £250 |

| Mobile Phone Monthly Plan | £13 |

| Home Internet | £32 |

Also Read: Cheapest Energy Suppliers In The UK: Energy Comparison

- Entertainment & Leisure Costs In The UK

In addition to rent, utilities, groceries, transportation, and dining, there are various other miscellaneous expenses to consider when budgeting for living in the UK. Here are some miscellaneous costs of living in the UK:

| Category | Cost in Pounds (£) |

| Fitness and Leisure (Gym Membership) | 35 |

| Shopping (Stores like Zara or H&M) | 30 – 75 |

| Entertainment (Cinema Tickets) | 10 |

- Cost Of Childcare And Schooling In The UK

The UK’s childcare and schooling costs can be significant, reflecting the high demand for quality education and care. Understanding these expenses is essential for financial planning for families considering private education.

Below is a table summarising the monthly cost of full-day preschool (or kindergarten) and the yearly cost of an international primary school for one child in the UK.

| Service | Cost |

| Full-day private preschool or kindergarten, monthly cost for one child | £1,265 |

| Annual tuition for one child at an international primary school | £15,451 |

- Healthcare Costs in the UK

The UK’s healthcare system is primarily delivered through the National Health Service (NHS), a publicly funded service offering comprehensive medical care to all legal residents. Most NHS services, such as GP visits, hospital treatment, and emergency care, are free at the point of use.

However, there are some exceptions, such as:

- Prescription charges (England only): £9.90 per item

- Dental treatments and eye tests: Partially subsidised or fully paid, depending on eligibility

- Mental health and specialist services: Generally free but may involve waiting times

Immigration Health Surcharge (IHS) for International Students & Graduates

If you are coming to the UK as an international student or staying after graduation on a Post-Study Work (PSW) visa, you will need to pay the Immigration Health Surcharge (IHS). This gives you full NHS access during your stay.

| Visa Type | Typical Duration | IHS Fee per Year | Approximate Total IHS Fee |

| Bachelor’s Degree | 3 years | £776 | £2,328 |

| Master’s Degree | 1 year (rounded) | £776 | £1,164 (incl. extra months) |

| Post-Study Work (PSW) | 2 years | £776 | £1,552 |

Also Read: Health Insurance For International Students In The UK 2025: Complete Guide

What Salary Is Needed to Live Comfortably in the UK?

To live comfortably in the UK in 2025, a single individual needs to earn around £30,500 per year after taxes, while a couple without children should aim for a combined annual income of at least £41,000 to £45,000. These figures reflect recent increases in living costs and wages, providing an updated guideline well above previous years.

| Household Type | Minimum Salary for Decent Living (2025) | Monthly After-Tax Income |

| Single Individual | £30,500 per year | £2,540 per month |

| Couple (No Children) | £41,000–£45,000 combined per year | £3,400–£3,750 per month |

Also Read: List Of High-Demand Jobs In The UK For Indians: 2025

Tips On Planning Your Budget Well And Managing Expenses

Managing your finances effectively in the UK requires careful planning and awareness of regular and occasional expenses. Here are some tips to help you plan your budget wisely and maintain financial stability:

- Track Your Expenses: Start by tracking your expenses for at least a month to understand where your money goes. Use budgeting apps like MoneyBox, Emma or spreadsheets to categorise and analyse your spending habits.

- Create a Budget: Based on your expense tracking, create a realistic budget that accounts for all essential expenses such as rent, utilities, groceries, transportation, and bills. Allocate a portion for savings and discretionary spending.

- Utilise Discounts and Offers: Take advantage of student discounts, membership benefits, and promotional offers to save money on purchases and services.

- Comparison Shop: Whether it’s groceries, utilities, or insurance, compare prices and services to get the best value for your money. Take advantage of loyalty programs and discounts.

- Use Public Transport: Opt for weekly or monthly passes for buses, trains, or the underground to save on daily commuting costs. Get a monthly Travelcard if you commute regularly, or use a Railcard (e.g, 26–30, Network Railcard) to save up to 1/3 on train fares.

- Utility Bills: Use energy-efficient appliances and turn off lights and electronics when not in use to lower electricity bills. Example: Install smart thermostats, switch off lights and appliances when not in use, and use platforms like Uswitch to switch to a cheaper energy supplier.

Living in the UK in 2025 requires thoughtful financial planning, especially with the rising cost of housing, transportation, groceries, and utilities. Whether you are a single professional, a couple, a student, or a family, understanding the breakdown of living expenses, accommodation, food, transport, and healthcare can help you budget effectively and maintain a comfortable lifestyle.

And if you are a student planning to study in the UK, don’t stress about the hassle of finding accommodation. UniAcco makes it easy by offering a wide range of verified student accommodations in the UK. You can explore and compare properties, filter by budget and amenities, and choose the one that best fits your needs and preferences, all in one place.

FAQs

Q1. What is the average cost of living in the UK?

Ans: The average cost of living in the UK (excluding rent) ranges from £800 to £1,200 per month, depending on location and lifestyle. Major cities like London can be significantly more expensive compared to smaller towns.

Q2. Is 3000 Pounds a good salary in the UK?

Ans: A salary of £3,000 per month (around £36,000 annually) is above the UK median income and can provide a comfortable lifestyle in many parts of the UK. However, in high-cost areas like London, it may require careful budgeting, especially if you’re renting.

Q3. What is the average rent in the UK?

Ans: The average monthly rent in the UK is around £1,100, but this varies widely by region. In London, average rent can exceed £2,000, while smaller cities or towns may offer rents under £800.

Q4. What is the minimum wage in the UK?

Ans: As of April 2025, the UK’s National Living Wage is £11.44 per hour for workers aged 21 and over. Rates are slightly lower for younger workers and apprentices.

Q5. What Are The Key Factors Influencing the Cost of Living In The UK?

Ans: Housing expenses, energy prices, food costs, and regional wage differences primarily influence the cost of living in the UK. Additional factors include transportation, taxation, childcare, and inflation, all of which impact individuals’ purchasing power and daily expenses.

0 Comments