Your rent, part-time pay, and daily spending will all pass through one decision you make early on, your bank account. According to the Higher Education Statistics Agency (HESA), over 732,000 international students were enrolled in UK universities in 2023/24, accounting for nearly one-quarter of the total student population.

Each intake, hundreds of thousands of students open local UK bank accounts to avoid high foreign transaction fees, delayed payments, and the hassle of managing money across borders.

Choosing the right UK bank account directly affects how smoothly you receive salaries, pay accommodation costs, and manage everyday expenses while studying.

This blog breaks down the 10 best student bank accounts in the UK, comparing eligibility, features, charges, and application steps for both international and home students.

Best Banks for Students in the UK: An Overview

| Bank | Account Name | Key Benefits | Fees & Charges to Expect |

| HSBC | International Student Bank Account | Built for international students, strong global support, no monthly fee | ~£5 international transfers, ~2.75% FX card fee |

| NatWest | Select Account | Reliable everyday banking, good digital tools | International transfer fees apply, FX card fees |

| Barclays | Standard Current Account | Wide branch network, strong mobile banking | £25 branch transfers, £6–£12 delivery fees, 2.99% FX fee |

| Lloyds | Classic Account | Simple daily banking, broad ATM access | £9.50 international transfers, 2.99% FX fee |

| Santander | Basic Current Account | Easy eligibility, no overdraft | £25 international transfers, 2.95% FX fee |

| TSB | Spend & Save Account | Cashback on bills, no monthly fee | £10–£17.50 transfers, 2.99% FX fee |

| Nationwide | FlexAccount | No monthly fee, optional overdraft | £20 international transfers, 2.99% FX fee |

| Halifax | Current Account | Strong digital banking, simple setup | £9.50 transfers, £2–£7 incoming, 2.99% FX fee |

| Revolut | Standard Account | Multi-currency account, fast transfers | FX markups on weekends, usage limits |

| Monzo | Current Account | Excellent budgeting tools, no FX card fees | Fees beyond ATM limits, some transfer charges |

Also Read: Which Are The Best Student Banks In The World 2025

Why is a UK Bank Account Necessary for Students?

- Everyday access to money, without friction

A UK bank account gives you complete control over your finances from day one. You can withdraw cash easily, make contactless payments, and manage spending through mobile banking apps with real-time alerts. In a country where over 85% of in-store payments are now cashless, a local account ensures you can pay seamlessly, whether it’s for transport, groceries, or university essentials, without delays or limitations linked to international cards.

- Lower costs by avoiding international transaction fees

Relying on overseas debit or credit cards can quietly drain your budget. Most international banks charge 2–3% per transaction and apply unfavourable exchange rates. These costs add up quickly on everyday purchases. A UK bank account removes these recurring charges, giving you clearer visibility over expenses and helping you budget more accurately throughout the academic year.

- Essential for tuition fees and student accommodation payments

Most UK universities and accommodation providers prefer, and often require, payments from a UK bank account. Tuition instalments, security deposits, and monthly rent are processed faster and more reliably through local transfers. A UK account also allows you to set up direct debits and scheduled payments, reducing the risk of missed deadlines, failed transactions, or late payment penalties.

- Mandatory for part-time work and salary payments

Students planning to work part-time in the UK need a local bank account to receive wages. Employers pay salaries via UK bank transfers, and international accounts are rarely accepted. With more than 55% of international students taking on part-time work, a UK account is essential for timely, hassle-free salary payments.

- Access to student-specific banking benefits

UK banks offer student-focused features designed to ease financial pressure. These may include interest-free overdrafts, cashback offers, retail discounts, and built-in budgeting tools. While eligibility varies for international students, even basic student accounts provide better financial flexibility than standard accounts. Some banks also increase overdraft limits gradually over the course of your degree, offering extra support during high-expense periods such as exam seasons or relocation months.

From opening a bank account to finding a place that feels like home, planning ahead makes all the difference. Explore verified student accommodation in the UK to find options designed around student life.

Find Your Ideal Student Home NowBest UK Bank Accounts for International Students

1. HSBC International Student Bank Account

HSBC’s International Student Bank Account is a UK current account explicitly designed for non-UK students to manage everyday spending, receive money from home, and bank digitally while studying in the UK.

Account Benefits:

- Strong international support: Ideal if you’re transferring money from home or already bank with HSBC in another country.

- No monthly maintenance fee: Helps keep everyday banking costs predictable.

- Home & Away Programme: Extra support before arrival and during your stay in the UK.

- Full digital banking: Easy money management through the HSBC app with Apple Pay and Google Pay.

Eligibility Criteria:

- 18 or older

- Have a valid ID

- Provide proof of a UK address

- Proof of your student status (such as an offer letter from a UK university).

Fees to Watch Out For:

| Charge Type | Fee Details |

| International payments (sending) | £5 per international transfer. |

| Foreign currency card payments | 2.75% fee on card payments made in a foreign currency. |

How to Apply:

- Visit the official HSBC UK website and select the “International Student Bank Account” option.

- Prepare the required documents, including your passport, UK visa/BRP, university offer or enrolment letter, and proof of UK address.

- Complete identity and eligibility checks as part of the application process.

- Once approved, your debit card and account details are sent to your UK address.

- Activate your account through HSBC’s mobile app or at an ATM and begin using it for payments and transfers.

2. NatWest Select Account

Designed for everyday banking, the NatWest Select Account is a standard UK current account commonly used by international students who are not eligible for student-specific accounts. It provides core banking features, including debit cards and digital access, making it suitable for managing daily expenses in the UK.

Account Benefits:

- Straightforward UK banking: Ideal for managing daily expenses like rent, groceries, and transport.

- No monthly account fee: No fixed charges for standard usage.

- Easy access to UK debit card & ATMs: Widely accepted across the UK.

- Optional arranged overdraft (subject to approval): Can help during short-term cash flow gaps.

Eligibility Criteria:

- Must be 18 years or older.

- Valid passport and UK visa/BRP required for international students.

- Proof of a UK residential address (such as university accommodation or tenancy agreement).

Fees to Watch Out For:

| Charge Type | Fee Details |

| Monthly account fee | No monthly maintenance fee for standard use. |

| International payments (sending) | Charges apply depending on destination and payment method. |

| Receiving international payments | Fees may apply based on payment type and amount. |

| Foreign currency card payments | Foreign currency transaction fees apply when spending in non-GBP currencies. |

| Overseas ATM withdrawals | Additional charges may apply depending on the ATM provider and country. |

How to Apply:

- Visit the official NatWest UK website or a local NatWest branch.

- Select the “Select Account” and begin the application online or in-branch.

- Provide required documents, including ID, visa/BRP, and proof of UK address.

- Complete identity and eligibility verification as requested.

- Once approved, receive your debit card and activate online and mobile banking.

3. Barclays Bank Account

Barclays offers a current bank account that many students can open for everyday banking in the UK. The traditional Student Additions Account exists for eligible UK students, but many international students instead open a standard current account with similar core features, like mobile banking and optional overdraft.

Account Benefits:

- Strong digital money management: Barclays’ app is known for advanced spending insights, real-time alerts, and budgeting tools that help students track expenses closely.

- No monthly maintenance fee: Keeps routine banking costs low while studying in the UK.

- Arranged overdraft option (subject to eligibility): Can provide short-term flexibility during high-expense periods like move-in or rent payments.

- Wide acceptance across the UK: Contactless debit card works seamlessly for daily spending and ATM withdrawals.

Eligibility Criteria:

- Age 18 or over.

- UK residential address

- UK mobile phone number for online/phone banking.

- For the specific Student Additions Account, Barclays normally requires you to have lived in the UK for 3+ years

Fees to Watch Out For:

| Charge Type | Fee Details |

| International payments (branch) | £25 per transaction when sending international payments from a Barclays branch. |

| International payments (online banking) | No Barclays fee when sending via online banking; however, overseas delivery charges of £6–£12 may apply. |

| Receiving international payments | £6 fee for receiving international payments over £100. |

| Foreign currency card payments | 2.99% fee on card payments made in a foreign currency. |

How to Apply:

- Visit the Barclays UK website and select the current account you want to open, or go to a local Barclays branch to start your application.

- Provide required documents such as a passport/ID, proof of UK address and your UK mobile number.

- Complete identity verification online or in-branch.

- Once approved, set up online/mobile banking and activate your debit card upon arrival.

4. Lloyds Bank Classic Account

Lloyds Bank’s Classic Account gives international students a reliable way to manage day‑to‑day money, even when dedicated student accounts are not an option. It combines a contactless debit card, mobile and online banking, and access to a vast network of branches and ATMs, making it well-suited for receiving funds from home, paying rent and bills, and everyday spending while studying in the UK.

Account Benefits:

- Extensive UK branch & ATM network: Useful for students who prefer in-person support alongside digital banking.

- No monthly account fee: Keeps everyday banking simple and predictable.

- Reliable digital access: Lloyds’ mobile and online banking platforms cover essential transfers, bill payments, and balance tracking.

- Straightforward setup: Often easier to open once you have a UK address and visa in place.

Eligibility Criteria:

- Must be 18 years or older.

- Valid passport and UK visa/BRP required.

- Proof of a UK address (such as university accommodation or rental agreement).

- UK mobile number for account setup and security verification.

Fees to Watch Out For:

| Fee Type | Details |

| International payments (sending) | £9.50 per transaction, with additional charges depending on destination and payment method. |

| International payments (receiving) | £2–£7 per transaction, based on the type and value of the incoming payment. |

| Foreign currency card payments | 2.99% foreign currency transaction fee, plus any additional network or merchant charges. |

| Overseas ATM withdrawals | Extra charges may apply depending on the ATM provider and country of withdrawal. |

How to Apply:

- Visit the Lloyds Bank UK website or a local Lloyds branch to start your application.

- Choose the Classic Account.

- Submit required documents, including ID, visa, and proof of UK address.

- Complete identity verification as requested by Lloyds.

- Once approved, receive your debit card, activate online banking, and start using your account.

A local bank account helps you handle rent, bills, and everyday spending. Pair that with reliable student accommodation with UniAcco to get fully set up before classes begin.

Find Verified Student Homes5. Santander Basic Current Account

The Santander basic UK current account is a practical option for international students who need simple, fee-free banking. It focuses on core features like a debit card and digital access, making it suitable for managing daily expenses without credit or overdraft facilities.

Account Benefits:

- Basic banking: No overdrafts or credit facilities, making it easier to control spending and avoid debt.

- No monthly account fee: Ideal for students who want predictable, low-risk banking costs.

- Debit card for everyday use: Supports contactless payments and ATM withdrawals across the UK.

- Digital access included: Santander’s mobile and online banking allow easy balance checks, payments, and transfers.

Eligibility Criteria:

- Must be 18 years or older.

- Valid passport and UK visa/BRP required.

- Proof of a UK address (such as a university accommodation letter or tenancy agreement).

Fees to Watch Out For:

| Charge Type | Fee Details |

| International payments (sending) | £25 per international payment. |

| Foreign currency card payments | 2.95% fee on card payments made in a foreign currency. |

How to Apply:

- Visit the Santander UK website or a local Santander branch to start the application.

- Select the Basic Current Account.

- Submit required documents, including ID, visa, and proof of UK address.

- Complete identity checks as requested by Santander.

- Once approved, receive your debit card and set up online and mobile banking.

6. TSB Spend & Save Account

The TSB Spend & Save Account is well-suited to everyday banking and is often used by students seeking a simple account with basic cashback benefits. It focuses on routine spending and digital banking rather than student-specific perks.

Account Benefits:

- Cashback on everyday spending: Earn cashback on selected bills and card purchases when monthly conditions are met.

- No monthly maintenance fee: Keeps basic banking affordable for students.

- Strong digital banking tools: Track spending, manage transfers, and monitor activity via TSB’s app.

- Debit card for daily use: Works for contactless payments and ATM withdrawals across the UK.

Eligibility Criteria:

- Must be 18 years or older.

- Valid passport and UK visa/BRP required for international students.

- Proof of a UK address (such as a university accommodation letter or tenancy agreement).

- Cashback features are conditional and require meeting monthly account usage requirements.

Fees to Watch Out For:

| Charge Type | Fee Details |

| International payments (sending) | £10–£17.50 per international payment, depending on destination and payment method. |

| Receiving international payments | £2–£7 per transaction, based on the type and value of the incoming payment. |

| Foreign currency card payments | 2.99% fee on card payments made in a foreign currency. |

How to Apply:

- Visit the TSB UK website or a local TSB branch to start the application.

- Select the Spend & Save Account.

- Submit required documents, including ID, visa, and proof of UK address.

- Complete identity verification as part of the application process.

- Once approved, receive your debit card and activate online and mobile banking.

7. Nationwide FlexAccount

Nationwide FlexAccount is a reliable, fee-free UK current account that combines easy-to-use digital tools with access to Nationwide’s branch network, offering flexibility both online and in person. With the option of a minor interest-free overdraft (subject to eligibility) and the benefits of building society membership, the FlexAccount offers a balanced option for students seeking everyday banking with a little extra security.

Account Benefits:

- Member benefits: As a Nationwide member, you may get access to exclusive savings products and occasional member-only rewards.

- No monthly account fee: Keeps everyday banking costs predictable.

- Small interest-free overdraft buffer (subject to approval): Helpful during short-term cash gaps like rent or move-in expenses.

- Strong digital + branch access: Manage finances easily online while still having in-branch support if needed.

Eligibility Criteria:

- Must be 18 years or older.

- Valid passport and UK visa/BRP required for international students.

- Proof of a UK residential address (such as a university accommodation or tenancy agreement).

Fees to Watch Out For:

| Charge Type | Fee Details |

| International payments (sending) | £20 per international payment. |

| Foreign currency card payments | 2.99% fee on card payments made in a foreign currency. |

How to Apply:

- Visit the Nationwide Building Society website or a local Nationwide branch and choose the FlexAccount.

- Provide required documents, including ID, visa, and proof of UK address.

- Complete identity and eligibility checks as part of the application.

- Once approved, receive your debit card and set up online and mobile banking.

8. Halifax Current Account (UK)

The Halifax Current Account is a dependable option for students seeking simple UK banking without eligibility restrictions tied to student status. With no monthly fees, a widely accepted debit card, and an easy-to-use mobile app, it supports everyday needs like paying rent, receiving part-time wages, and managing daily spending.

Account Benefits:

- No maintenance fees: Ideal for managing daily expenses without recurring charges.

- Easy-to-use digital banking: Halifax’s app makes it simple to track spending, pay bills, and transfer money.

- Arranged overdraft option (subject to approval): Can offer short-term flexibility during high-spend months.

- Widely accepted debit card: Works seamlessly for contactless payments and ATM withdrawals across the UK.

Eligibility Criteria:

- Must be 18 years or older.

- Valid passport and UK visa/BRP required for international students.

- Proof of a UK residential address (such as university accommodation or tenancy agreement).

Fees to Watch Out For:

| Charge Type | Fee Details |

| International payments (sending) | £9.50 per international payment, plus additional fees depending on destination and payment method. |

| Receiving international payments | £2–£7 per transaction, based on the type and value of the incoming payment. |

| Foreign currency card payments | 2.99% foreign currency transaction fee, with additional charges potentially applied by card networks or merchants. |

How to Apply:

- Visit the Halifax UK website or a local branch and select the relevant current account to start your application.

- Provide required documents, including ID, visa, and proof of UK address.

- Complete identity and eligibility checks as part of the process.

- Once approved, receive your debit card and activate online and mobile banking.

9. Revolut Standard Account

Revolut’s Standard Account is an app-based, digital current account that has become popular with international students for managing everyday spending and cross‑border finances. It lets you hold and exchange multiple currencies at competitive rates, spend worldwide with a physical or virtual card, and send or receive money internationally much faster than with many traditional bank accounts.

Account Benefits:

- Multi-currency banking in one app: Hold, exchange, and spend in multiple currencies at competitive rates, ideal for receiving money from home or travelling during breaks.

- No monthly fee on the Standard plan: Keeps everyday banking costs low.

- Fast international transfers: In-app transfers are quicker and often cheaper than traditional banks (within free limits).

- Strong app controls: Instantly freeze cards, set spending limits, and track expenses in real time.

Eligibility Criteria:

- Must be 18 years or older.

- Valid government-issued ID required for verification.

- UK residential address needed.

Fees to Watch Out For:

| Charge Type | Fee Details |

| Monthly account fee | No monthly fee on the Standard plan. |

| International transfers | Free up to plan limits; fees apply beyond limits depending on currency and method. |

| Foreign currency exchange | Free within fair usage limits; markups may apply on weekends. |

| ATM withdrawals | Free up to a monthly limit; charges apply once the free allowance is exceeded. |

How to Apply:

- Download the Revolut app from the App Store or Google Play.

- Select the Standard plan and begin the application.

- Upload your ID and complete in-app identity verification.

- Enter your UK address and personal details.

- Once approved, you’ll receive your debit card and can start using the account in the app.

10. Monzo Current Account

Monzo’s Current Account is a digital‑only UK account built around a powerful mobile app, making it especially convenient for international students managing daily spending. It offers instant spending notifications, easy budgeting tools, fee‑free card use in the UK, and competitive fees for most everyday overseas card payments, making it well-suited as a primary day‑to‑day account.

Account Benefits:

- Real-time spending notifications: Every transaction updates instantly, helping students stay on top of their budget.

- No monthly fee on the standard account: Simple, predictable costs for daily banking.

- Excellent budgeting tools: Built-in spending summaries and pots make it easier to manage rent, groceries, and bills.

- Fee-free foreign card payments: Useful for occasional overseas spending without extra charges.

Eligibility Criteria:

- Must be 18 years or older.

- Valid passport or government-issued ID required.

- UK residential address.

- Cash and cheque deposits are limited and may require PayPoint locations.

Fees to Watch Out For:

| Charge Type | Fee Details |

| Monthly account fee | No monthly fee on the standard account. |

| Foreign currency card payments | No fees for card payments made in foreign currencies (exchange rate applies). |

| International transfers | Fees apply depending on currency and destination. |

| ATM withdrawals abroad | Free up to Monzo’s allowance; charges apply once limits are exceeded. |

How to Apply:

- Download the Monzo app from the App Store or Google Play.

- Select the standard current account and begin the application.

- Upload your ID and complete in-app identity verification.

- Add your UK address and personal details.

- Once approved, your debit card is sent to your UK address, and the account becomes usable immediately.

For real‑world perspectives from students, read this Quora thread that collects opinions and comparisons on which bank works best for international students in the UK:

Steps to Open a UK Bank Account as an International Student

Step 1: Choose the right type of account

Start by deciding whether you want a student account or a basic current account. Many international students begin with a standard current account because some student accounts require prior UK residency. Focus on banks that clearly support international students and offer easy onboarding.

Step 2: Secure a UK address

Most banks require proof of a UK address before activating your account. This can be your university accommodation letter, private rental agreement, or a bank letter issued by your university. Having this ready can significantly speed up the process.

Step 3: Prepare your documents

You will typically need your passport, UK visa or BRP, university offer or enrolment letter, and proof of address. Some banks may also ask for your CAS letter or a letter from your university confirming your student status.

Step 4: Apply online or visit a branch

Several UK banks allow you to start the application online, but you may still need to visit a branch for identity verification. Booking an appointment in advance, especially during peak student intake months, can save time.

Step 5: Complete identity verification

Banks will verify your identity and visa status before approving the account. Once verified, your debit card is usually sent to your UK address within 5–7 working days.

Step 6: Activate and start using your account

After receiving your card, activate it via the bank’s app or ATM, set up online banking, and link it to your rent payments or part-time job. You are now ready to manage your finances like a local student.

Also Read: How to open a student bank account in the UK

What Should You Look for in a UK Student Bank Account?

1. Transparent fees and everyday charges

Most UK student bank accounts do not charge a monthly fee, but costs can still appear in less obvious places. International card usage, overseas ATM withdrawals, and cross-border transfers often attract extra charges. For international students who move money frequently, these small amounts can compound quickly. Reviewing the full tariff before opening an account helps you avoid surprises later and keeps your monthly spending predictable.

2. Overdraft access and flexibility

An overdraft can act as a short-term safety net when expenses arrive before your stipend, salary, or family transfer. Around 80% of UK student bank accounts offer interest-free overdrafts, usually between £1,500 and £3,000 over the course of a degree. That said, overdraft limits are not automatic. Eligibility varies by bank, and international students may face additional checks or lower limits. Always confirm whether the overdraft is guaranteed or subject to approval.

3. Mobile and online banking experience

Day-to-day money management in the UK is almost entirely digital. With more than 40% of students rarely using cash, a reliable mobile app is essential. Look for features such as real-time transaction alerts, easy bill payments, budgeting tools, and instant card freeze options. A well-designed app makes it easier to track spending, stay organised, and respond quickly if something goes wrong.

4. Cost of international transfers

Traditional banks may charge £9–£15 per international money transfer, often combined with unfavourable exchange rates. If you expect regular funds from home, check both transfer fees and currency conversion margins carefully. Many students keep a UK bank account for local use and pair it with a digital transfer service to reduce overall costs.

5. Customer support and accessibility

Strong customer support is significant during your first months in the UK. Banks that offer multiple support channels like branches, phone lines, and in-app chat are easier to deal with. Having a branch near your university or quick access to help when a card fails or a payment is delayed, can save time and unnecessary stress.

6. Student perks and added benefits

Some student accounts include extras such as railcards, cashback offers, or shopping discounts. A railcard alone can save over £100 a year on travel. While these benefits are helpful, they should never outweigh core factors such as low fees, dependable banking, and responsive support.

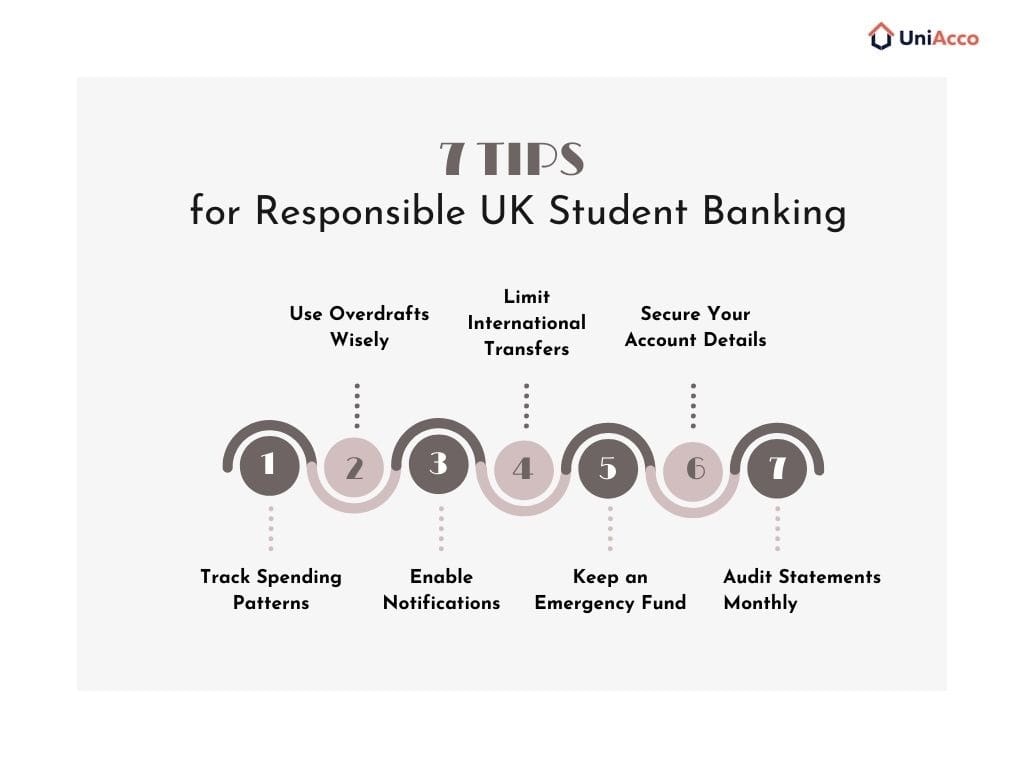

Tips for Using Your UK Student Bank Account Responsibly

- Monitor your spending regularly: Use your bank’s mobile app to track daily expenses. Keeping an eye on transactions helps prevent overspending and ensures you don’t run out of funds unexpectedly.

- Treat your overdraft as a safety net: An overdraft is meant for short-term emergencies, not as extra income. Relying on it monthly can lead to financial stress and potential fees once the interest-free limit is exceeded.

- Set alerts and reminders: Enable balance notifications and payment reminders to stay on top of bills, subscriptions, and upcoming expenses. This avoids late fees and keeps your account in good standing.

- Minimise international transfers: Only transfer money abroad when necessary. Compare fees and exchange rates before sending funds to avoid unnecessary charges.

- Maintain an emergency buffer: Keep a small reserve in your account for unexpected costs like travel, medical bills, or urgent purchases. This provides financial security and peace of mind.

- Protect your account information: Never share your card, PIN, or one-time passwords. Maintaining confidentiality prevents fraud and unauthorised transactions.

- Review statements monthly: Check your account statements each month for incorrect charges or suspicious activity. Early detection helps resolve issues quickly and ensures accurate account management.

Alternatives to UK Student Bank Accounts

If you are unable to open a UK student bank account immediately, there are a few alternatives that can help you manage money temporarily or alongside a UK account. These options are especially useful during your first few days or weeks in the UK, but they are not long-term replacements for a local bank account.

| Option | Pros | Cons | Best Suited For |

| Forex cards | Locked exchange rates, safer than cash, easy to use on arrival | Cannot receive salaries or pay rent, reload fees apply | First few days in the UK |

| Home-country debit/credit cards | Immediate usability, useful in emergencies | High FX fees, poor exchange rates | Short-term or backup use |

| Digital banks (Monzo/ Revolut/ Wise) | Fast setup, low FX fees, strong budgeting tools | Limited cash deposits are not always accepted for official payments | Daily spending & transfers |

1. Forex Cards

Forex cards are prepaid cards loaded with foreign currency before travel and issued by banks in your home country. Many students use a forex card to pay for groceries, transport, or meals during their first week before their UK bank account is active. However, forex cards cannot be used to receive part-time job salaries or pay rent and tuition fees.

2. International Debit or Credit Cards

International debit or credit cards from your home bank can be used across the UK for shopping or emergency cash withdrawals. For instance, a student might use their home debit card to book a train ticket or pay for essentials while waiting for their UK debit card to arrive. Over time, foreign transaction fees and exchange rate markups can make this option expensive.

3. Digital Banks & Fintech Accounts

Digital accounts are app-based and can be set up within a day. Students commonly use accounts like Monzo or Revolut for everyday spending, such as paying rent shares to flatmates, splitting bills, or managing weekly budgets. While convenient, these accounts may not support cash deposits or be accepted by all universities or landlords for official payments.

A reliable home is as important as a reliable account. Use UniAcco to find trusted student accommodation in London and other top UK cities for a smooth, secure transition to university life.

Explore Trusted Student Homes in LondonSumming Up!

Managing money in a new country doesn’t have to be complicated. The best student bank accounts in the UK simplify tuition and rent payments, support part-time earnings, and help you track daily expenses efficiently. Compare fees, overdraft options, digital tools, and student perks, and you can select an account that keeps your finances secure, flexible, and stress-free, letting you focus on your studies, experiences, and life in the UK.

Banking done, next up comes comfort and convenience. Browse verified listings for student accommodation in the UK with UniAcco and settle into a space that supports both study and lifestyle.

0 Comments